The latest estimates expected India’s economic growth to rise by 6.4%. This fear drives future expectations. Last year’s GDP growth was 8.2%.

It is anticipated that the Indian economy’s growth rate will drop significantly next year to 6.4%. China’s economy is growing at its slowest rate since the epidemic. This slowdown is happening in several key areas.

Table of Contents

Toggle

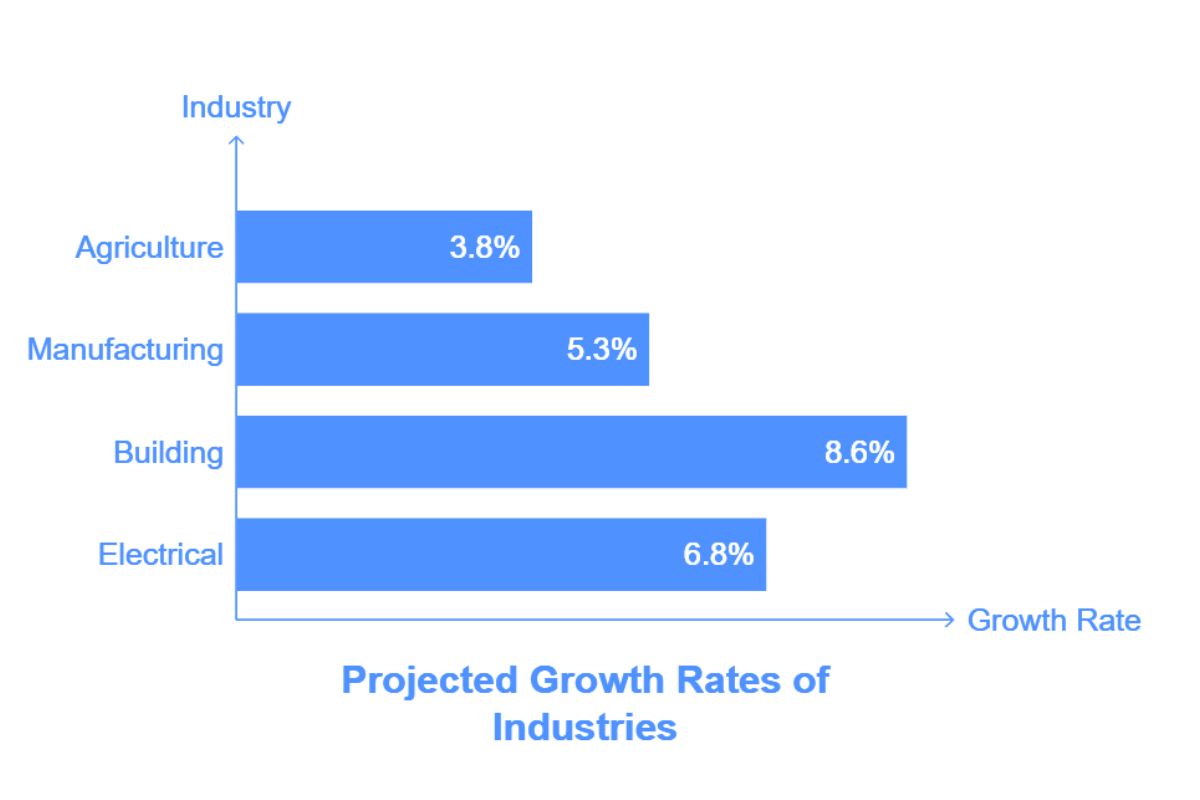

Most industries are expected to slow down. However, agriculture is set to grow. It has a projection of 3.8%, up from 1.4% last year. With a growth rate of 9.9% last year, manufacturing was a key driver of growth; this year, it is expected to increase at a rate of 5.3%. The building industry is expected to grow by 8.6%, a drop from 9.9%. Meanwhile, the electrical sector should increase by 6.8%, down from 7.5% last year.

Slower growth is anticipated in FY25 for the major GDP contributors, including manufacturing, trade, hotels, financial services, and real estate. The purchasing power of the urban poor has been eroded by inflation, which has also had a significant impact on urban consumption.

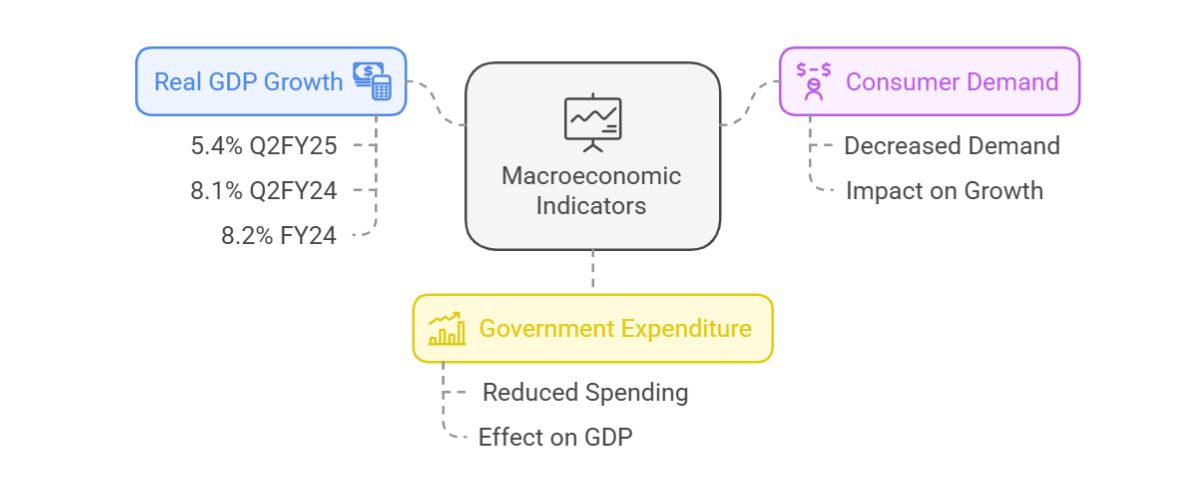

The macro socioeconomic panorama in CY24 was a mixed picture. After last year’s exuberant performance, the main indicators displayed signs of waning strength in 1HFY25. Growth in real GDP eased slightly this year to 5.4% (yoy) in Q2FY25 from 8.1% Q2FY24, dropping off steeply compared with the 8.2% aggregate rate of FY24, mainly due to lighter consumer demand and some reduction in government expenditure.

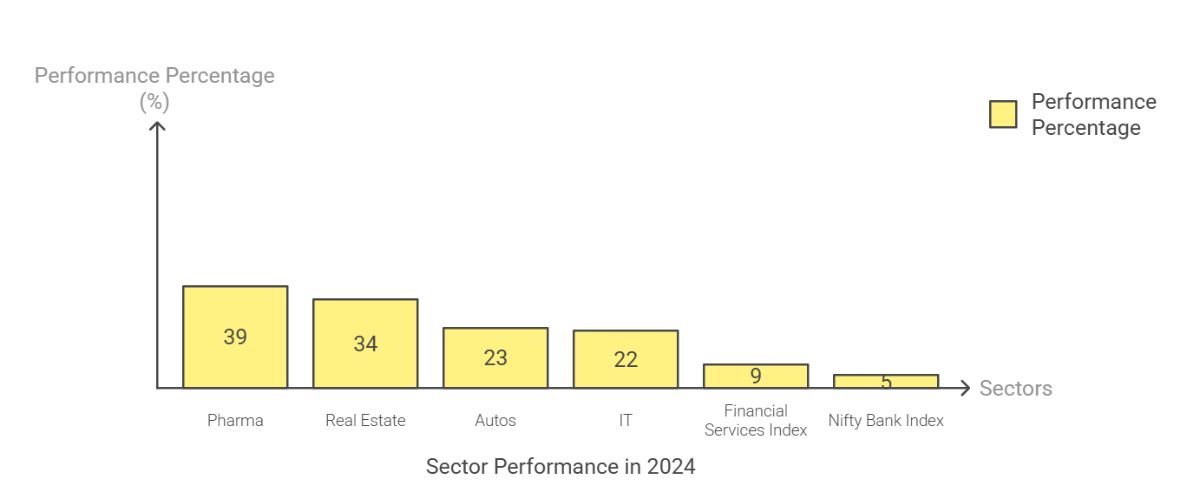

Indian stocks kept rising, facing big challenges at home and abroad. The Nifty50 gained 9%. Now, India’s market cap is USD 5.2 trillion, making up 4.2% of the world market capitalisation. For the year, the Midcap and Smallcap indices are set to give returns of around 24%.

Pharma led with a +39% increase, followed by Real Estate at +34%. Autos rose by +23%, and IT grew by +22%. The broader financial services index rose by 9%, matching Nifty50 returns. However, the Nifty Bank index, which mainly includes large private banks, only gained 5% this year.

The year faced big challenges both globally and at home. These included geopolitical tensions, ongoing inflation, a stronger USD, and high interest rates. Globally, events like the US Fed’s rate cuts and China’s stimulus led to big market swings. Geopolitical issues, like the US presidential election, also played a role.

As of May 2025, India’s economic outlook is a bit lower. Growth is now expected to be 6.2% for FY25, down from 6.4%. This revision shows ongoing inflation, weak export demand, and lower government spending. The services sector was once strong, but now it’s slowing down. This is because global demand is falling and borrowing costs are high.

Meanwhile, private consumption remains subdued, especially in rural regions, where wage growth is lagging behind inflation. India’s macroeconomic fundamentals stay strong. This is supported by stable foreign exchange reserves and managed fiscal deficits, even with the challenges. The RBI is widely expected to initiate a rate cut cycle in Q3 FY25, which may offer stimulus for the latter half of the fiscal year.

The Reserve Bank of India (RBI) shifted to a neutral stance. It kept policy rates the same because inflation is still high, above the RBI’s 4% threshold, but showing signs of moderation. The rate cut by the RBI is expected in February 2025.

India’s economic growth forecast for FY25 paints a picture of a slowing economy, with several sectors experiencing a decline in growth rates. The government’s fiscal policies and the RBI’s approach to inflation and growth are key. They will shape the overall economic outlook.