Table of Contents

Toggle

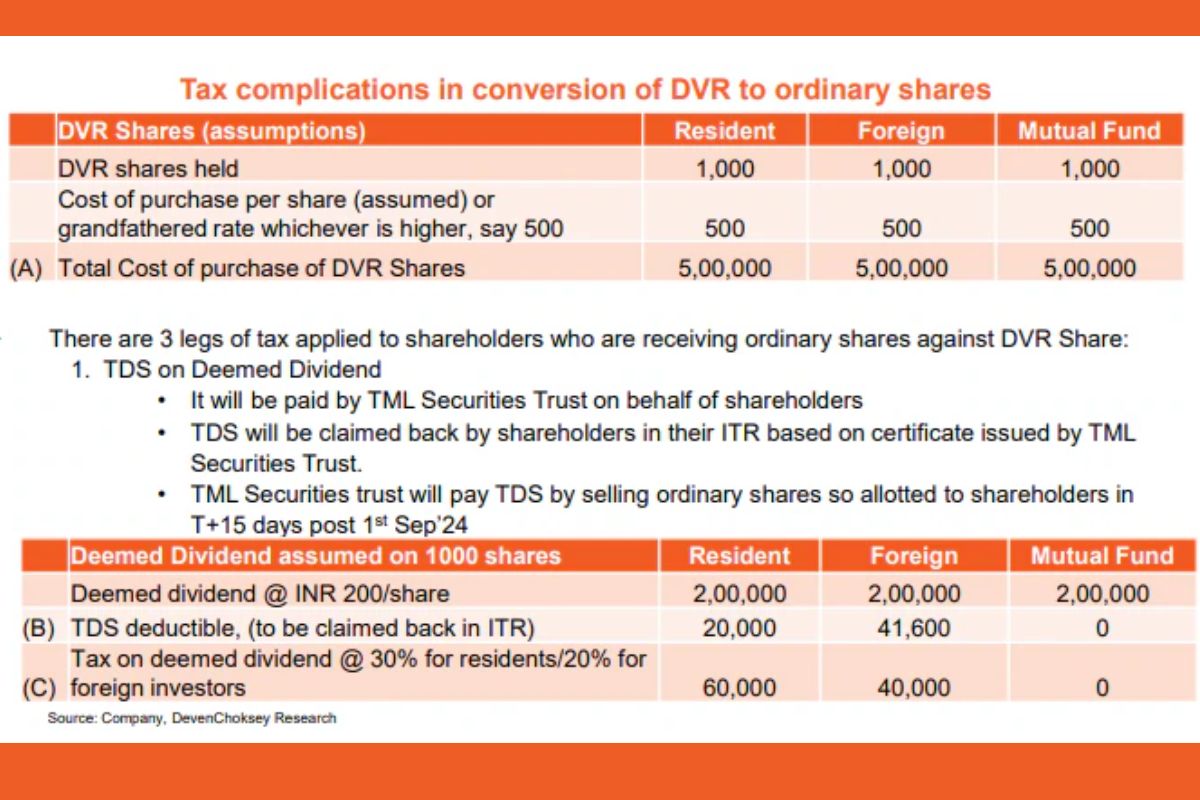

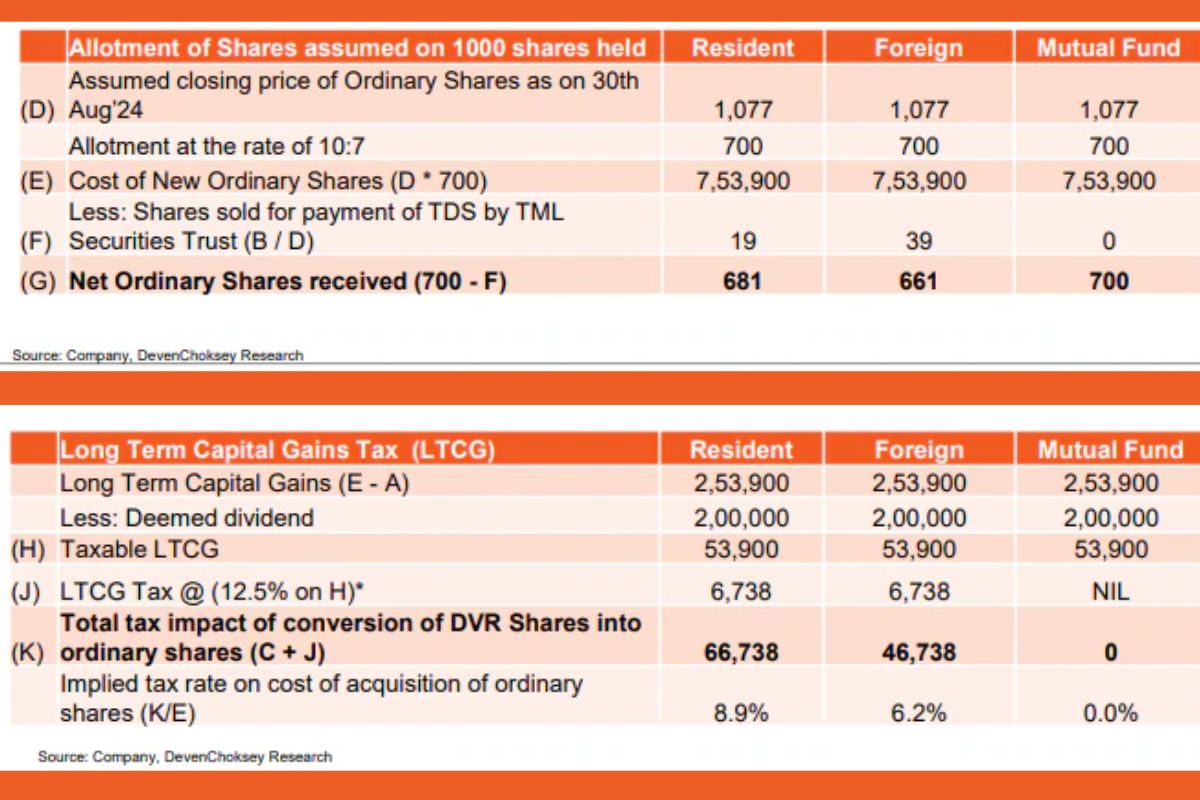

Tata Motors is converting DVR shares to regular shares to keep things simple and attract more big investors. Many global investors like companies that have one kind of share and equal voting rights. This move helps Tata Motors build trust. It boosts market appeal and clarifies things for all shareholders.

The suspension and conversion of Tata Motors DVR Shares can affect shareholders in several ways:

Tata Motors has made a significant move. They are suspending and converting their DVR shares. This change will help simplify their share structure and provide owners with more options. The conversion process has several steps and will have tax effects, but the end result should be good for both the company and its owners. As Tata Motors makes this change, investors will watch closely. They want to see how the market reacts and how this smart move pays off in the long run.